Tech-Driven Accounts Payable Process

However, with a fully integrated accounting platform that’s specific to restaurants, you can easily trace your food cost to sales ratio every day. Your POS system is integrated with your accounting software, so all data entry is automated. Your AP automation captures all invoices, keeping track of your inventory and food costs. Your integrated bank information is reconciled, confirming the data entry. With restaurant-specific accounting software, you are able to easily track your food cost to sales ratio every day, helping you stay on top of your financial health.

A restaurant-specific AP automation solution streamlines the accounts payable process, improving the process and generating increasing value no matter how many locations you open. Accrual-basis businesses rely on the cash flow statement to analyze their cash position. Accrual-basis income statements reflect revenue and expenses the company has recognized, which can differ from the cash that has come in or left the business. An accrual business would record a payable in its accounting software once it receives the invoice. A cash-basis business would wait to recognize the inventory purchase until it paid the bill.

Getting Started with Accounting for Your Restaurants

While many industries experience spoilage — when their inventory is no longer usable — restaurants must actively assess their inventory at least once a week. When you’re sitting at a table waiting for your appetizer to arrive, it’s easy to think restaurants are businesses just like any other. Those who own and run restaurants know the fire they face in the kitchen, both literally and figuratively. When your chart of accounts is set up in this manner all you have to do is modify your profit and loss with the correct settings. Depending on the type of restaurant you run, though, costs may be higher or lower.

The other thing we love about Shogo is the ability to quickly and easily reconcile merchant service deposits. The Shogo journal entry allows you to reconcile your merchant service deposits so you can ensure you are getting all the money you are due. You need to analyze how funds are hitting your bank and set up your restaurant bookkeeping system to mirror that activity. One of the first items you will have to figure out is how to properly record your sales. Many find using QuickBooks for restaurants is an effective recording system.

Cash flow statement

Generally speaking, the accounts payable cycle follows a standard process and is sometimes called procure to pay, or P2P. Companies begin by determining the number of items they need, procuring those items, and looking for suppliers. Once the items are delivered, they receive an invoice and pay that invoice, and the cycle repeats. Some businesses have accounts payable sub-processes, but for the most part, it follows a fairly unchanging pattern.

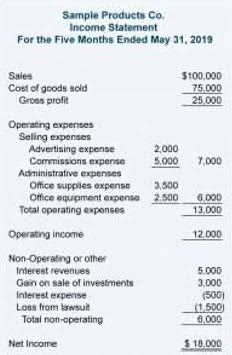

AP automation software can transform the way you manage your accounts payable process, freeing you from the time constraints of managing everything by hand. Restaurant businesses can benefit from this software and become better equipped to train teams on how to restaurant bookkeeping properly handle AP-related tasks. Multi-step income statements separately state a restaurant’s gross profit margin, or the difference between net sales and food and beverage costs. “Cost of goods sold” refers to the products you buy that make up your product.

What is Net Operating Income in a restaurant?

Once you’ve nailed down your goals, the next step is to create a plan to achieve them. While specific goals will vary from restaurant to restaurant, here are some steps you can take to set restaurant accounting goals for your venue. Several factors can impact a restaurant’s profit margin, all of which should be closely monitored through your accounting processes. Modern POSs leverage data analysis tools to give you additional reporting insights into sales by section, voids, and staff activities so you can assess staff performance and cut costs.

The cost of goods sold represents the costs of making and selling your products at any given time, including inventory costs. Paying your bills on time and keeping your vendors and suppliers happy is essential for the efficient functioning of a restaurant. This is further broken down into business-specific categories or sub-accounts, such as inventory, sales, and marketing. While setting up the chart of accounts, it’s important to decide the metrics you want to monitor. Manual AP processes require your store-level managers to spend valuable time on data entry, rather than being on the floor.

It also eliminates the time, effort, and many of the errors inherent to manual accounting processes. Accounting software helps you and your accountant stay on the same page. By connecting seamlessly with your POS, accounting software automates the collection and organization of financial data and transactions. At first blush, cash-based accounting might seem like the best kind for restaurants.

- While specific goals will vary from restaurant to restaurant, here are some steps you can take to set restaurant accounting goals for your venue.

- Unlike manual AP processing, AP automation enables you to systematically address and eliminate errors to improve quality.

- FreshBooks offers a balance sheet, general ledger, COGS report, Account Payable, Chart of Accounts, Journal Entries, and access to professional accountants ready to tackle any problems that arise.

- Whichever way you look at it, restaurants operate with razor-thin profit margins, emphasizing how crucial it is to keep on top of your restaurant accounting.

- As you grow you will have to continually modify your bookkeeping system to meet your needs.

- The difference between assets and liabilities is equity, also called the net book value of a company.